Sell Your Dubai Property With Ease and Reach the Right Buyer

Unlock lucrative opportunities with EQX Real Estate LLC.

Benefit from high rental yields, no property taxes, and investor-friendly regulations.

Invest in Dubai Real Estate—Simple, Smart, Seamless

Book Your Call Below

Why Work with EQX Real Estate?

1. Access to International Buyers

• We connect sellers with a global network of high-net-worth investors.

•Our reach extends beyond local markets, maximizing exposure for your property.

2. Exclusive Access to American Buyers

• We specialize in sourcing and working with U.S.-based investors.

• Our strong relationships in the American market ensure premium opportunities.

3. Private Funding Solutions

• As a private funding company, we provide tailored financial solutions for buyers and investors.

• We facilitate fast and flexible financing, making deals smoother and more efficient.

4. Specialized Agents in Every Area

• Our expert agents focus on specific regions, ensuring in-depth local market knowledge.

• Clients benefit from insights into pricing trends, market dynamics, and investment opportunities.

5. Exclusive Off-Market Listings

• We offer access to high-value properties before they hit the public market.

• Investors and buyers gain an advantage in securing prime real estate.

6. Seamless End-to-End Service

• From property sourcing to financing and closing, we handle every step.

• Our clients enjoy a stress-free, white-glove real estate experience.

7. Strong Global Network

• Our connections span developers, investors, and financial institutions worldwide.

• This ensures better deals, quicker transactions, and premium investment opportunities.

8. Expert Market Insights & Advisory

• We provide clients with up-to-date market trends, investment strategies, and financial guidance.

• Our data-driven approach helps buyers and sellers make informed, profitable decisions.

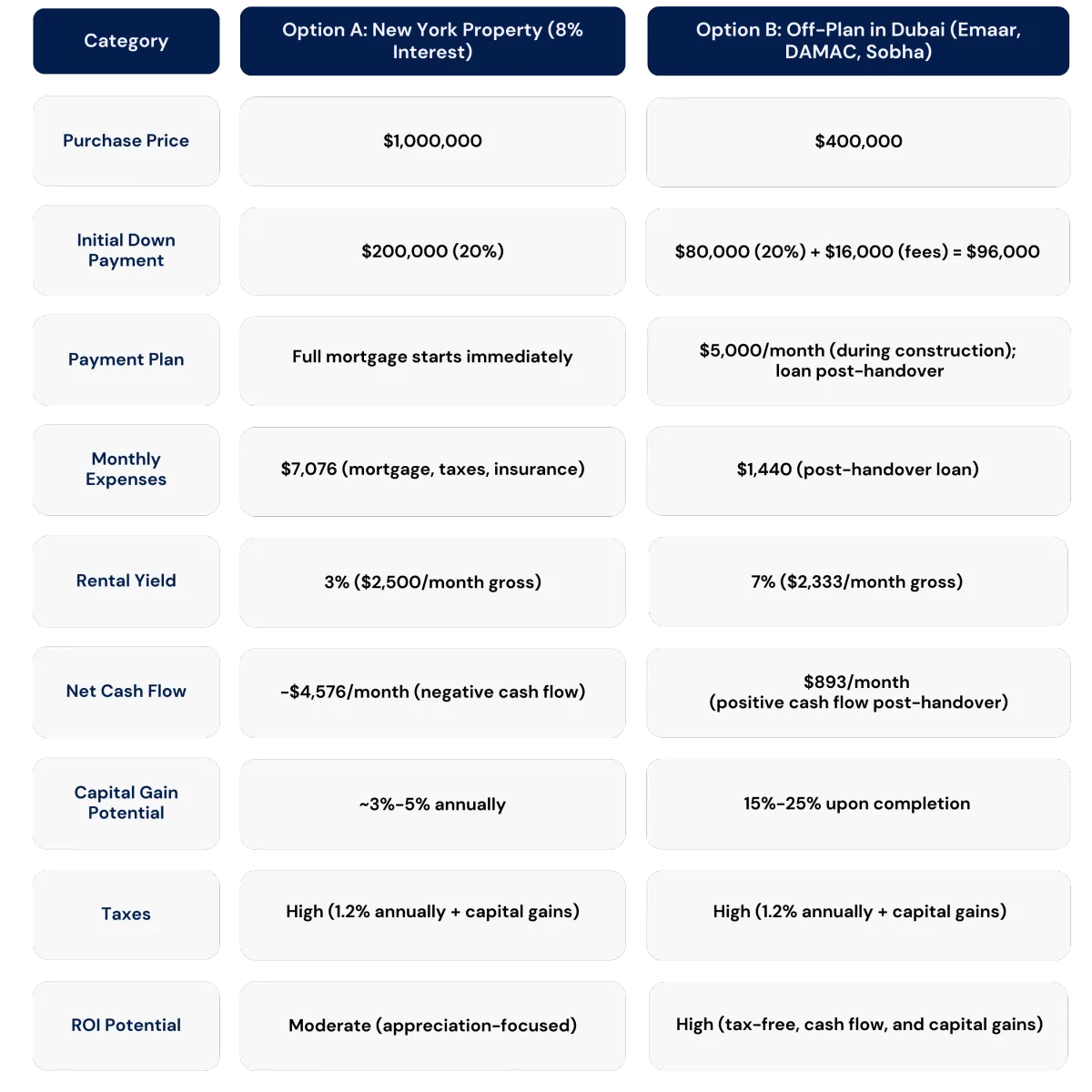

OPTION - A

Buying an Investment Property in New York

Assumptions:

Average Purchase Price (NYC): $1,000,000

Down Payment: 20% = $200,000

Loan Amount: $800,000 (80% Loan-to-Value)

Interest Rate: 8% (fixed for 30 years)

Property Taxes: 1.2% of property value annually (NYC average)

Insurance: $2,500 annually

Rental Yield: 3% annual gross yield (typical in New York investment markets).

Costs:

Monthly Mortgage Payment (Principal & Interest):

•Loan of $800,000 at 8% interest over 30 years = $5,868/month.Property Taxes:

• Annual tax = 1.2% of $1,000,000 = $12,000, or $1,000/month.

Insurance:

• $2,500 annually = $208/month.

Total Monthly Expenses:

$5,868 (mortgage) + $1,000 (taxes) + $208 (insurance) =

$7,076/month.

Rental Income:

•Gross Rental Yield: 3% of $1,000,000 = $30,000 annually, or $2,500/month.

Net Monthly Cash Flow:

•$2,500 (rental income) - $7,076 (expenses) = -$4,576/month (negative cash flow).

Capital Gain Potential (Appreciation):

New York properties appreciate at ~3%-5% annually on average.

Over 5 years, a $1,000,000 property could grow to ~$1,159,000-$1,276,000, yielding a capital gain of $159,000-$276,000 (subject to capital gains taxes).

OPTION - B

Buying Off-Plan Property in Dubai from EMAAR, DAMAC, or Sobha

Assumptions:

Purchase Price: Starting at $400,000 (AED 1,472,000 approx.)

Payment Plan :

• 40% during construction (paid over 3-4 years).

• 60% on handover (loan option available post-handover).Taxes and Fees: 4% Dubai Land Department (DLD) fee on purchase price.

Rental Yield (Post-Handover): ~7% annual gross yield.

Capital Gain Potential: Properties typically appreciate by 15%-25% upon completion, depending on location and demand.

Costs During Construction:

Down Payment (Initial):

• 20% of $400,000 = $80,000 upfront.Construction Payment Plan (40% Over 4 Years):

• 40% of $400,000 = $160,000 spread over 4 years = $3,333.33/month during construction.

Taxes and Fees:

• 4% DLD fee = $16,000 (one-time).

Post-Handover (40% Loan Option):

Remaining Balance:

• 40% of $400,000 = $160,000(can be financed through a mortgage).

Monthly Loan Payment:

• Assuming a 3.5% interest rate, $160,000 financed over 15 years = $1,143.81/month.

Rental Income (Post-Handover):

•Gross Rental Yield: 7% of $400,000 = $28,000 annually, or $2,333/month.

Net Monthly Cash Flow (Post-Handover):

• $2,333 (rental income) - $1,440 (loan payment) = $893/month positive cash flow.

Capital Gain Potential (Appreciation):

15%-25% appreciation:

• Upon completion, the property value may rise to $460,000-$500,000, providing a capital gain of $60,000 to $100,000 (tax-free).

Book Your Call Below

Why Choose Option B (Dubai Off-Plan Investment)?

Zero Interest During Construction: Payment plans allow investors to fund their property without additional borrowing costs.

Tax-Free Investment: No recurring property taxes, income taxes, or capital gains taxes in Dubai.

Higher ROI: Dubai offers ~7% rental yields and 15%-25% capital appreciation upon completion, outperforming New York’s rental and appreciation potential.

Flexibility: Post-handover financing options let investors manage cash flow while generating rental income.

Lower Initial Costs: Dubai’s $400,000 starting price and affordable payment plans make it accessible to more investors.

At EQX Real Estate, we have exclusive stock with Dubai’s most trusted developers, including Emaar, Damac, and Sobha, tailored for American investors.

Contact us today to explore your next investment opportunity!